Who is Winning the Retail Pharmacy Consumer Battle?

Who is Winning the Retail Pharmacy Consumer Battle? Marissa Plescia

CVS Health has recently overtaken Walgreens as the most popular drugstore retailer among drugstore/pharmacy shoppers. Over the last several quarters, the companies have been flip-flopping between first and second place. It’s not clear whether CVS will be able to sustain this lead given the similar profiles it has with Walgreens. But one thing is clear: Both have a hefty lead over the other retail pharmacies — including Walmart Pharmacy, Rite Aid and Kroger — mentioned in the quarterly survey from Coresight Research.

However, the popularity contest in the future may not be about just in-store purchases.

Some experts say there could be a shift in the future with a focus on mail order and online pharmacies.

What the numbers show

The Coresight Research report found that 49.2% of over 300 respondents purchased pharmacy products from CVS Health in the previous three months (surveyed July 29), compared to 44.3% from Walgreens, 19.5% from Walmart Pharmacy, 12.7% from Rite Aid and 12.1% from CVS Pharmacy inside Target stores. For the previous quarter (which was surveyed on May 6), 44.4% of shoppers purchased from Walgreens, and 43.5% of shoppers purchased from CVS Health.

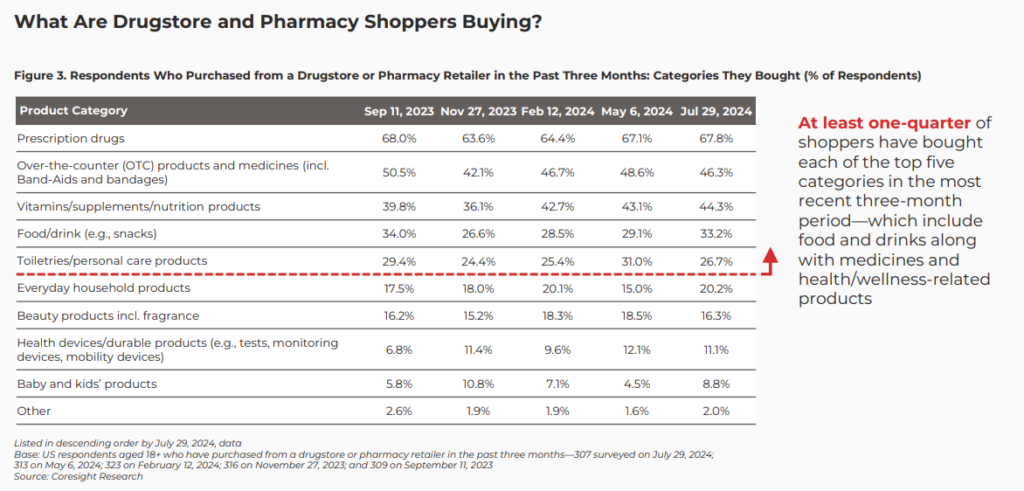

The products purchased can be seen below:

“Walgreens has been closing more stores than CVS, so there’s a relative difference between the store footprints they have,” said Aditya Kaushik, analyst for Coresight Research, in an interview. “CVS has more stores in the U.S. if we compare it to Walgreens, so that would be a major reason [for CVS overtaking Walgreens]. And then CVS has an insurance company as well — Aetna. So it has an edge over Walgreens in terms of its insurance company. Consumers are bound to shift towards the CVS stores because if they just purchased from CVS pharmacies, they can claim insurance easily.”

According to their websites, Walgreens has “nearly 9,000 stores in all 50 states, the District of Columbia, Puerto Rico and the U.S. Virgin Islands,” while CVS has “more than 9,000 pharmacy locations, including those in Target and Schnucks grocery stores.”

Kaushik added that CVS and Walgreens have a serious advantage over the other retail pharmacies since around 70% to 80% of the U.S. population lives within five miles of either drugstore.

CVS and Walgreens did not return requests for comment.

What does the future of retail pharmacy look like?

While CVS and Walgreens may be the dominant players right now, there may be some challenges in the future.

Kaushik noted that the healthcare industry is “undergoing a profound transformation,” and that technology-enabled solutions and consumer-centricity will be a focus for pharmacies. This is particularly true as online competitors gain popularity, like Amazon.

Another healthcare expert said he expects there to be a shift in the retail pharmacy market.

“In my view, the real question is whether the retail footprint of Walgreens and CVS are the Blockbuster and Hollywood Video of retail pharmacy, with Amazon as the Netflix,” said Hal Andrews, CEO and president of healthcare analytics company Trilliant Health, in an email.

Blockbuster and Hollywood Video were DVD and VHS rental stores that went out of business as new models of viewing movies emerged with Netflix, which initially allowed people to rent DVDs from their online catalog with the DVDs arriving in the mail. Blockbuster ultimately closed in 2014 while Hollywood Video had capitulated earlier in 2010.

“Recent public announcements by Walgreens and Walmart indicate an increasing focus on specialty pharmacy. In such an event, the competition between the retail pharmacy companies is how quickly they can adapt to mail order,” Andrews continued.

He noted, however, that both CVS and Walmart could be in positions to make this shift.

“Given that CVS’s revenue from mail and specialty pharmacy is almost the size of Walgreens’ entire pharmacy business and 5X the size of Rite Aid’s entire pharmacy business, CVS seems well positioned,” Andrews said. “On the other hand, Walmart’s massive scale in rural markets and their legendary logistics capabilities distinguishes them from their urban counterparts.”

Competition is not limited to that among brick and mortar retail pharmacies.

A health consultant — Nathan Ray, partner of healthcare and life sciences at West Monroe — noted that these traditional retail drugstore chains face growing competition from Amazon Pharmacy and Mark Cuban Cost Plus Drug Company.

The increased competition comes at a time of tempering ambitions in healthcare for at least two retailers.

Walmart is shuttering its health clinics and Walgreens is exploring selling its stake in VillageMD. Despite these challenges, Ray said he doesn’t anticipate any retailers moving away from pharmacy business ventures.

“I think anyone that has pharmacy is going to continue to have it,” he said in an interview. “What exact shape and form that takes is going to evolve as competition and the cost to fill [evolves]. All of these things play out over time with new technology, new expectations for just relationship and service level. … None of [the retailers] have completely given up some of the healthcare aspirations they have. The problem is that they, in most cases, are trading off strategies that are low yield or low return, and maybe circling back to things that they had already in place.”

Ray’s colleague echoed his comments, noting that there will always be a place for retailers when it comes to pharmacy.

“A lot of the customers and patients in these areas like to build relationships with their pharmacists and get to know them. And they trust them, rely on them for their different advice and care and such,” said Joel Brock, partner of retail at West Monroe, in an interview. “And so that store, the neighborhood component will really never go away in retail. And I think that’s one of the big pieces that will keep pharmacy embedded in retailers.”

For this quarter at least, CVS Health seems to be in the lead. But only time will tell how it will fare in the future.

“CVS and Walgreens have head-to-head competition, since both CVS and Walgreens operate in all 50 states and often have locations in the same town or city, the makeup of the two chains’ potential market trade area is quite similar — indicating that both drugstores mostly reach to the same types of households,” Kaushik said. “So we can’t be sure that we will see a trend in any one chain leading over the other.”

Photo: VectorInspiration, Getty Images