The Rise and Fall of Olive AI: Lessons from a Healthcare Unicorn

The Rise and Fall of Olive AI: Lessons from a Healthcare Unicorn Multiplatform.AI

- Olive AI, a healthcare startup, witnessed rapid growth in 2020 and 2021, securing substantial funding and expanding its presence in U.S. hospitals.

- The company’s success was driven by the digital health funding boom and the need for automation during the COVID-19 pandemic.

- Olive’s valuation reached an impressive $4 billion, backed by major investors.

- However, the company’s fortunes reversed, resulting in the sale of core business units, layoffs, and eventual closure of operations.

- Olive AI’s story reflects broader challenges in the health tech market, where adaptability and strategic planning are crucial.

Main AI News:

In the annals of business success stories, Olive AI’s meteoric rise and subsequent decline serve as a cautionary tale. Just a few short years ago, Olive was hailed as a unicorn in the healthcare startup arena. The year 2020 marked the beginning of its ascent, fueled by the digital health funding boom and the pressing need for automation in response to the COVID-19 pandemic.

During that transformative period, Olive managed to secure a staggering $225 million in funding in December 2020, propelling its valuation to an impressive $1.5 billion. Remarkably, a mere seven months later, it closed a monumental $400 million funding round, catapulting its valuation to an astounding $4 billion. Backed by prominent investors such as General Catalyst, Ascension Ventures, Oak HC/FT, and SVB Capital, the company raked in a total of $832 million in funding within a span of just over a year, starting from March 2020.

In 2021, Olive AI’s enterprise AI solutions found a place in over 900 hospitals across more than 40 U.S. states, including more than 20 of the top 100 U.S. health systems. It seemed like Olive was destined for unbridled success.

However, the narrative took an unexpected turn, and Olive AI’s fortunes began to wane. The company’s operations started to contract steadily throughout the past year. Fast forward to today, and the once high-flying unicorn has made a startling announcement – it is divesting its remaining assets and ceasing its operations.

Olive’s strategic move involves selling its core assets, including the clearinghouse and patient access business units, to Waystar and the prior authorization business unit to Humata Health. This decision, according to Olive, is aimed at ensuring the stability and prosperity of these businesses. With the core units offloaded, Olive will gracefully wind down the rest of its operations.

The inception of Olive AI in 2017 was born out of a vision to streamline and expedite the high-volume, repetitive, and manual tasks that burden healthcare workers daily. The company’s journey included the acquisition of AI software provider Verata Health to tackle prior authorization challenges head-on. The period from 2020 onwards witnessed a remarkable growth trajectory, with Olive amassing a total of $902 million in funding.

Olive’s foray into the operating room came with the acquisition of Empiric Health, an AI-powered clinical analytics and service company specializing in identifying unwarranted clinical variation, particularly in surgery. This strategic move broadened Olive’s capabilities in supply chain management and clinical analysis for surgical procedures.

However, as the economic landscape took a downturn in July 2022, Olive had to make the difficult decision of laying off 450 employees. The company’s CEO, Sean Lane, acknowledged the challenging economic conditions and admitted to “missteps” in the company’s strategy. Lane cited industry shifts, evolving customer expectations, and challenging market conditions as the factors that contributed to Olive’s turbulent journey.

In an effort to navigate these challenges, Olive began shedding segments of its business. Reports surfaced that the company planned to transfer a substantial portion of its products and services to sibling company Rotera. In February, another 215 employees were let go, further underscoring the company’s turbulent path.

In April of the same year, health tech solution provider Availity made a significant move by acquiring Olive’s artificial-intelligence-enabled utilization management solution for payers, a system designed to automate prior authorization approvals.

The story of Olive AI’s rise and fall is not unique in the healthcare tech landscape. It joins the ranks of other health tech “unicorns” that have faced similar fates in recent times. Babylon Health, a digital primary care provider, had to sell most of its assets to U.S.-based eMed Healthcare through a bankruptcy process. Pear Therapeutics, once a high-flying digital therapeutics startup, met a similar fate as its assets were auctioned off for just over $6 million.

Conclusion:

The rise and fall of Olive AI underscore the volatile nature of the health tech market. While initially thriving due to the pandemic-driven demand for automation, the company’s inability to adapt and evolve in a changing landscape led to its decline. This serves as a cautionary tale for the industry, emphasizing the importance of agility and long-term strategic planning to navigate uncertain market conditions.

Analysis from Thomas Hagemeijer on LinkedIn

I was a big believer in OliveAI, so I was especially shocked when the company declared last week that it was ceasing its operations!

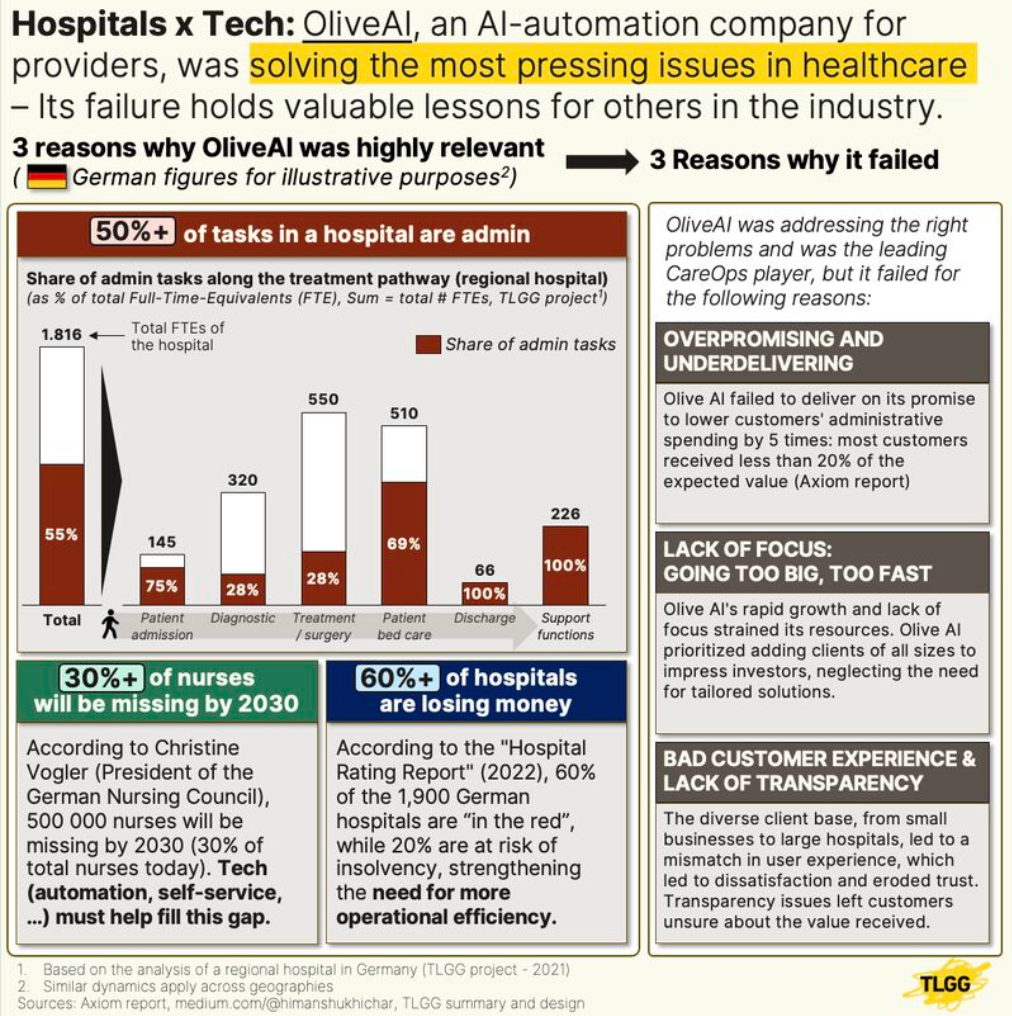

OliveAI developed an innovative approach to using artificial intelligence (AI) to streamline and automate repetitive, high-volume, and manual tasks within healthcare organizations, especially hospitals.

Mid 2021, the valuation of OliveAI reached $4 billion!

Now it is bankrupt.

We wrote down a few thoughts:

1️⃣ 𝐇𝐨𝐬𝐩𝐢𝐭𝐚𝐥𝐬 𝐝𝐨𝐧'𝐭 𝐰𝐚𝐧𝐭 𝐬𝐭𝐚𝐧𝐝-𝐚𝐥𝐨𝐧𝐞 𝐬𝐨𝐥𝐮𝐭𝐢𝐨𝐧𝐬, 𝐛𝐮𝐭 𝐨𝐧𝐞 𝐬𝐨𝐥𝐮𝐭𝐢𝐨𝐧 𝐜𝐚𝐧𝐧𝐨𝐭 𝐟𝐢𝐱 𝐞𝐯𝐞𝐫𝐲𝐭𝐡𝐢𝐧𝐠

This was one of the major mistakes of OliveAI: trying to address too many problems at once. We are at a dead end for innovators, where stand-alone solutions won't get attention and "one fits all" solutions like OliveAI will fail.This environment favours the incumbents like Epic, Cerner or Dedalus.

2️⃣ 𝐇𝐨𝐬𝐩𝐢𝐭𝐚𝐥𝐬 𝐡𝐚𝐯𝐞 𝐧𝐨 𝐦𝐨𝐧𝐞𝐲: 𝐩𝐫𝐨𝐯𝐢𝐧𝐠 𝐭𝐡𝐞 𝐑𝐎𝐈 𝐬𝐡𝐨𝐮𝐥𝐝 𝐛𝐞 𝐭𝐡𝐞 𝐡𝐢𝐠𝐡𝐞𝐬𝐭 𝐩𝐫𝐢𝐨𝐫𝐢𝐭𝐲

Any HealthTech solution should aim for 5x to 10x ROI as a general rule.A senior leader from a German hospital recently told me: "Ideally, we would not pay anything upfront. A good example is the contingency model of a start-up we are working with: they optimize hospitals' booking codes and just take a commission on the extra revenues they generate."

3️⃣ 𝐀𝐝𝐝𝐫𝐞𝐬𝐬𝐢𝐧𝐠 𝐭𝐡𝐞 𝐔𝐒 𝐜𝐚𝐧 𝐛𝐞 𝐜𝐡𝐚𝐥𝐥𝐞𝐧𝐠𝐢𝐧𝐠 𝐟𝐨𝐫 𝐒𝐚𝐚𝐒 𝐁𝟐𝐁 𝐬𝐨𝐥𝐮𝐭𝐢𝐨𝐧𝐬, 𝐛𝐮𝐭 𝐝𝐞𝐚𝐥𝐢𝐧𝐠 𝐰𝐢𝐭𝐡 𝐄𝐮𝐫𝐨𝐩𝐞 𝐢𝐬 𝐞𝐯𝐞𝐧 𝐦𝐨𝐫𝐞 𝐜𝐨𝐦𝐩𝐥𝐞𝐱.

The challenges in Europe are: understaffed hospital IT departments, lack of incentives (in many countries), average customer size, sales cycles and highly fragmented IT landscapes.This fosters more professional service types of solutions, rather than highly scalable SaaS models.

4️⃣ 𝐎𝐧 𝐚 𝐩𝐨𝐬𝐢𝐭𝐢𝐯𝐞 𝐧𝐨𝐭𝐞: 𝐚𝐮𝐭𝐨𝐦𝐚𝐭𝐢𝐨𝐧 𝐨𝐟 𝐚𝐝𝐦𝐢𝐧 𝐭𝐚𝐬𝐤𝐬 𝐢𝐧 𝐄𝐮𝐫𝐨𝐩𝐞𝐚𝐧 𝐡𝐨𝐬𝐩𝐢𝐭𝐚𝐥𝐬 𝐜𝐚𝐧 𝐰𝐨𝐫𝐤!

A chief physician of a regional hospital in Germany has built an internal Robotic-Process-Automation (RPA) team, consisting of 2.5 FTEs: 1 RPA expert, 1 Physician-assistant (clinical workflow expert) and 0.5 IT resource.

The team is using a leading RPA software solution. The team has already freed-up 5% of capacity (across nurses, physicians and non-medical staff) and is aiming for 15% to 20% in the next 3 years!