Is Walmart becoming a tech company?

Is Walmart becoming a tech company? Jacqueline Tubbs

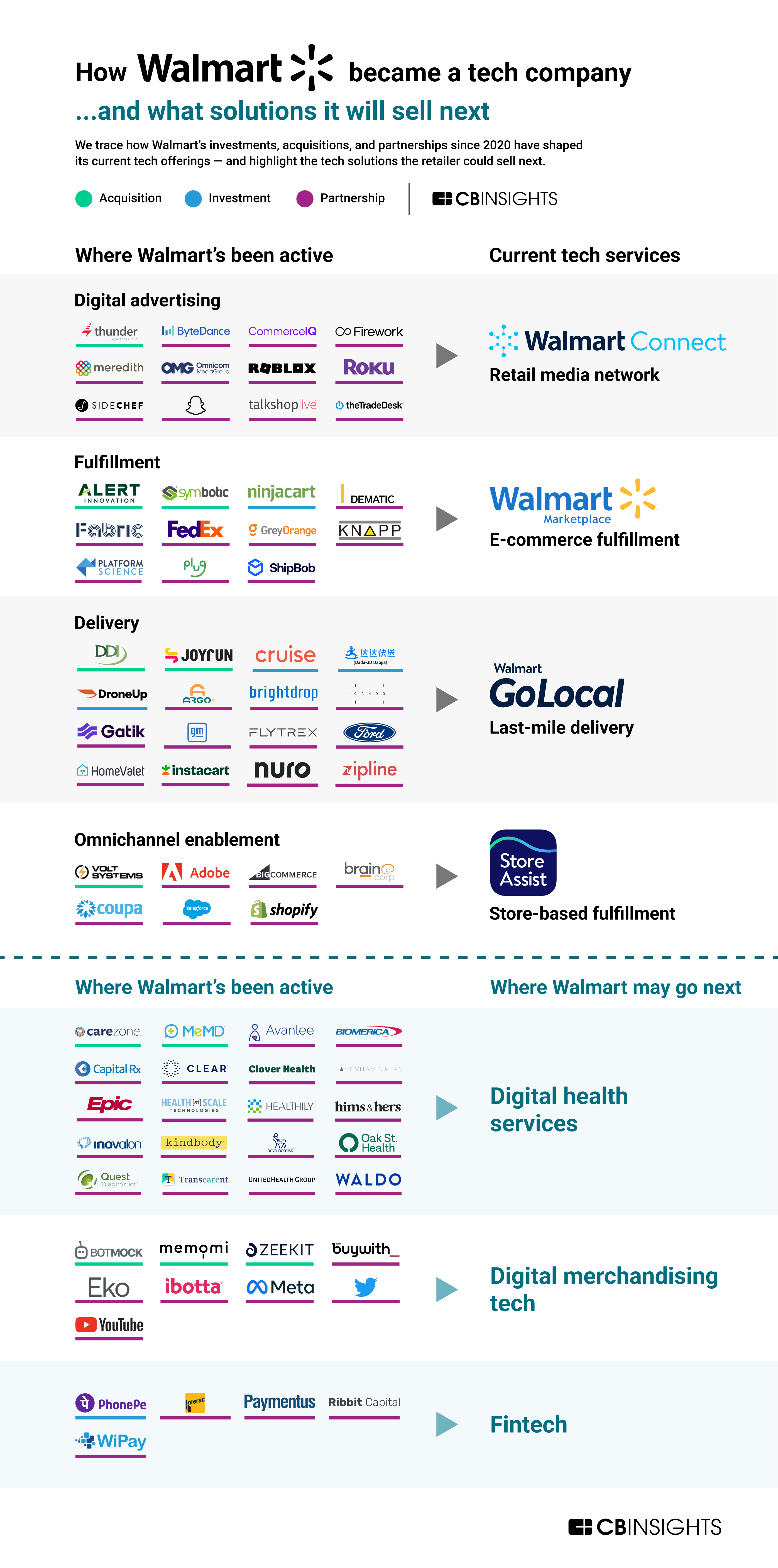

By positioning itself as a B2B tech provider, Walmart could command a higher valuation than traditional grocery retail. We break down how the retail giant built its tech offerings — and the 3 sectors it'll take on next.

With more than 10,500 stores in 24 countries and global annual revenues exceeding half a trillion dollars, Walmart has long shaped the world of brick-and-mortar commerce.

Now, it’s establishing itself as a tech provider — similar to the likes of Amazon — by launching high-margin, high-growth-rate tech businesses for the retail industry. This could change financial markets’ perception of the company’s growth potential and help it achieve a higher valuation than traditional grocery retail.

Armed with data from its 37M daily global customers and one of the world’s most efficient supply chains, Walmart has been rolling out a suite of omnichannel tech products. Just last month, the retail giant announced it would make several of its fulfillment and delivery tech products available to other retailers via Salesforce’s app marketplace.

These designations are not exhaustive of Walmart’s investment and partnership activity in the analyzed period.

For Walmart, selling these tech services opens up a vital source of revenue. The retailer is not alone: Retailers across the board have looked to new revenue streams as forces like inflation, inventory issues, and labor shortages have challenged sales and profits. But Walmart’s size and influence could uniquely position it to take on Amazon and other big tech players.

We used the CB Insights platform to trace how Walmart has built its potential as a tech provider through in-house experimentation and outside investments and acquisitions. We also profile 3 tech services the retailer could sell next.

Walmart’s current tech services

WALMART CONNECT

What is it?

Walmart’s media network, Walmart Connect, enables brands to create sponsored campaigns on the retailer’s website and in its stores. Walmart Connect drew $2.1B in revenue in 2021 and reported 30% YoY growth in Q2’22. For comparison, Amazon made $9.5B from ad revenue in Q3’22.