As digital health funding fell in Q3, a new normal emerged

As digital health funding fell in Q3, a new normal emerged unknown

Investments drift away from pandemic-era spaces, toward workflow solutions and value-based care

2022 saw the highs of the pandemic investment into digital health officially collapse, with investments dropping in every single quarter from the one prior. Things seemed to bounce back a bit in Q1, but the last two quarters have once again showed that things are still slowing down.

That could be the new normal, according to data from Rock Health, which showed digital health startups in the U.S. raising $2.5 billion across 119 deals in Q3, making it the second-lowest quarter by funding total since the fourth quarter of 2019, aka the one right before the pandemic hit.

This is also the fourth of the five past quarters to log funding in the $2 billion range, the exception being Q1 of this year, though all five saw deals in the low 100s, with Q1 again being the outlier with 131.

How far has digital health fallen in just the last two years? 2021's total was a record breaking $29.2 billion; 2022 ended up down 48% from that sum, and 2023 is looking like it will see another significant downturn: there was $8.6 billion raised across 365 deals in the first three quarters of the year, down 32% from the $12.6 billion invested at the same time in 2022, and down 20% from the 458 deals in the first three quarters of the prior year.

This year is on track to see total investments of around $11.5 million, which would be down 25% from 2022, and a whopping 60% from 2021. Rock Health, however, believes this might be a good thing, as there are signs that things have stabilized in the space.

"If Q1 and Q2 2023 charted the course for a brave new venture market, Q3 gave clear signals of the world emerging. While the digital health sector experienced significant reductions in funding and deal volume, quarterly trends are stabilizing within a new investment cycle. Investors are funding startups exploring new treatment pathways and tackling nonclinical workflow solutions," it said in the report.

"Taking this all together, digital health’s new reality is 'smaller but mighty.'"

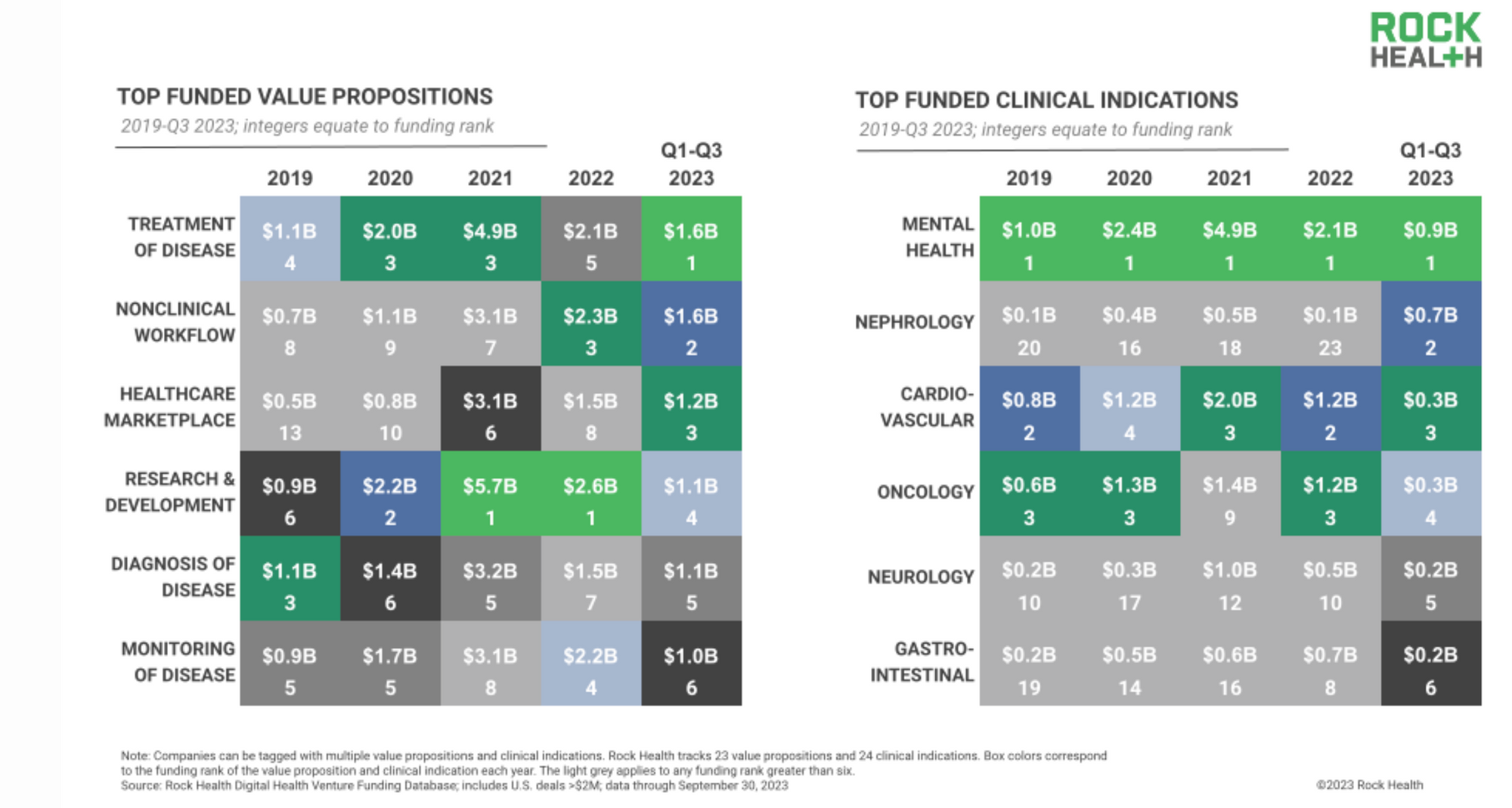

In this new normal, investors are also looking at new spaces: as COVID recedes from view, so do the spaces that benefitted the most, as funding shifted away from on-demand healthcare and life science R&D catalysts, which Rock Health notes where the top investment areas throughout the last two years. Now there's more focus now on digital health products and services that support disease treatment, nonclinical workflow, and management of complex conditions such as kidney disease.

As usual, mental health was the clinical indication that saw the most funding, with $900 million invested into it in 2023 to date; the bigger surprise was how much went into nephrology, aka kidney care: it has raised $700 million through the first three quarters of this year, compared to just $54 million raised all of last year. Another space that is seeing increased interest in value-based care, with companies like Better Life Partners raising $26.5 million, and Healthmap Solutions raising $100 million.

"As related policy initiatives gain momentum and large healthcare enterprises dig deeper into VBC models, VBC enablement will become an important component of startups’ commercial roadmaps and will drive enterprise partnerships. This will be particularly true in high-cost therapeutic areas like mental health, kidney care, cardiovascular care, and oncology—not-so-coincidentally the top four clinical indications by funding on our Q3 2023 chart," wrote Rock Health.

One area where digital health has suffered, along with the rest of the market, is in IPOs, made even worse by the fact that two publicly-traded companies, Pear Therapeutics and Babylon Health, both went bankrupt, while another, NextGen Healthcare, went private again by selling to a private equity firm.

However, according to Rock Health, the digital health cohort's public market performance trajectory is strong: from the opening of Q1 to the close of Q3 2023, the Rock Health Digital Health Index, which averages the stock performance of digital health companies trading on the NASDAQ and NYSE1, underperformed the S&P 500, but beat out the S&P 500 Health Care and Nasdaq Biotechnology Index.